For several years, Spencer Stuart has been exploring the backgrounds and demographics of chief financial officers (CFOs) in ASX 100 companies. Based on this research, and in conjunction with our decades of work with global leaders, we’ve analysed the careers of Australia’s top 100 finance leaders in 2017 and their rise to the C-suite. Here are the highlights from our analysis of the top 100 public Australian companies, as well as a look at trends we’re seeing.

Rate of turnover nearly doubled

2017 represented an active year for CFO turnover in the ASX 100, with 17 percent of companies appointing new CFOs. That’s almost twice the turnover rate in the previous year, when 9 percent of ASX 100 companies appointed new CFOs. Seventy-six percent of the CFOs appointed in 2017 were external appointments.

Analysed by industry, more than half (53%) of new CFO appointments were in the industrial sector, and 24 percent were in financial services. The only other industry with a double-digit percentage of turnover was consumer goods, at 12 percent. These percentages seem to generally align with the ratio of companies in industrial, financial services and other sectors in the ASX 100.

Diversity remains an opportunity

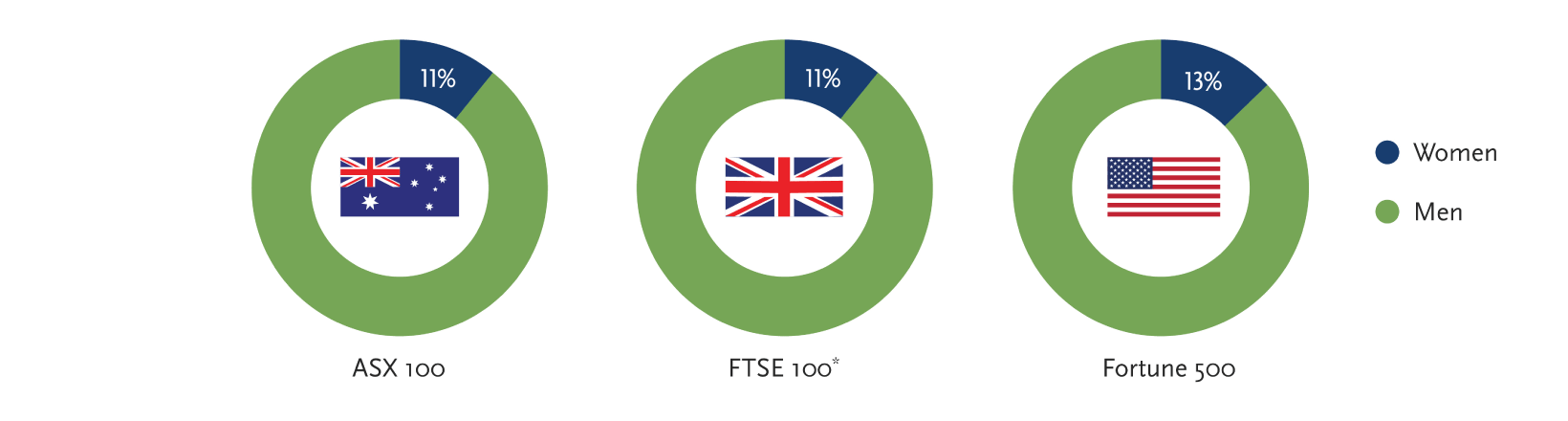

Similar to other markets, 89 percent of the finance leaders in the top 100 organisations are male, with limited evidence of ethnic diversity. Female representation remains low, notwithstanding the proactive focus Australian organisations have put on making gender-diverse appointments.

By comparison...

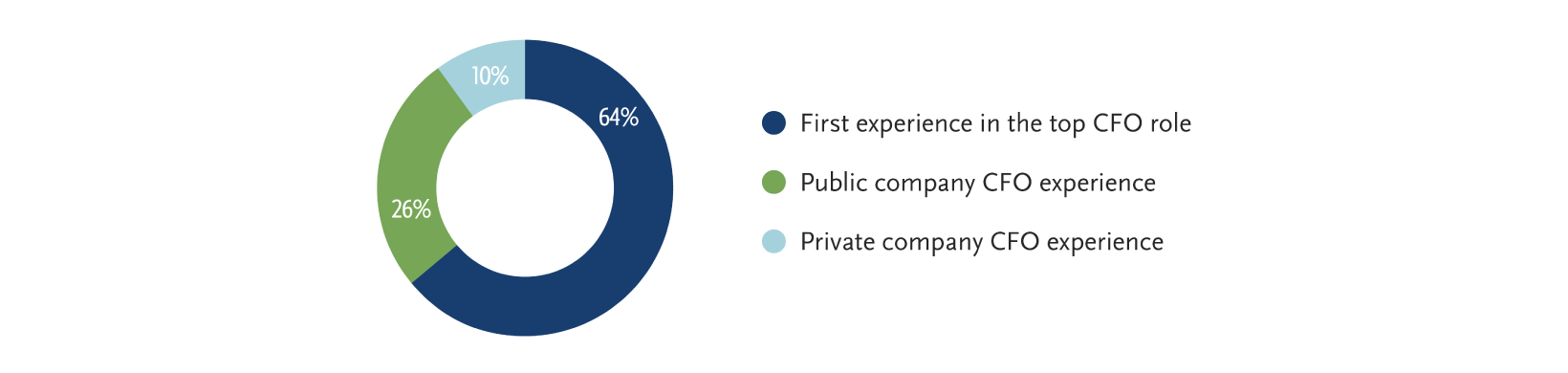

Experience in the top role not essential

Aspiring CFO-track executives should be encouraged that almost two-thirds (64%) of ASX 100 CFOs are serving as group CFO for the first time. As expected, proven group CFO experience was more prevalent in external hires than internal appointments. Of the external appointments who have previous CFO experience, the majority (79%) worked for ASX 100 companies, which illustrates the value placed on exposure to a public company’s operating environment.

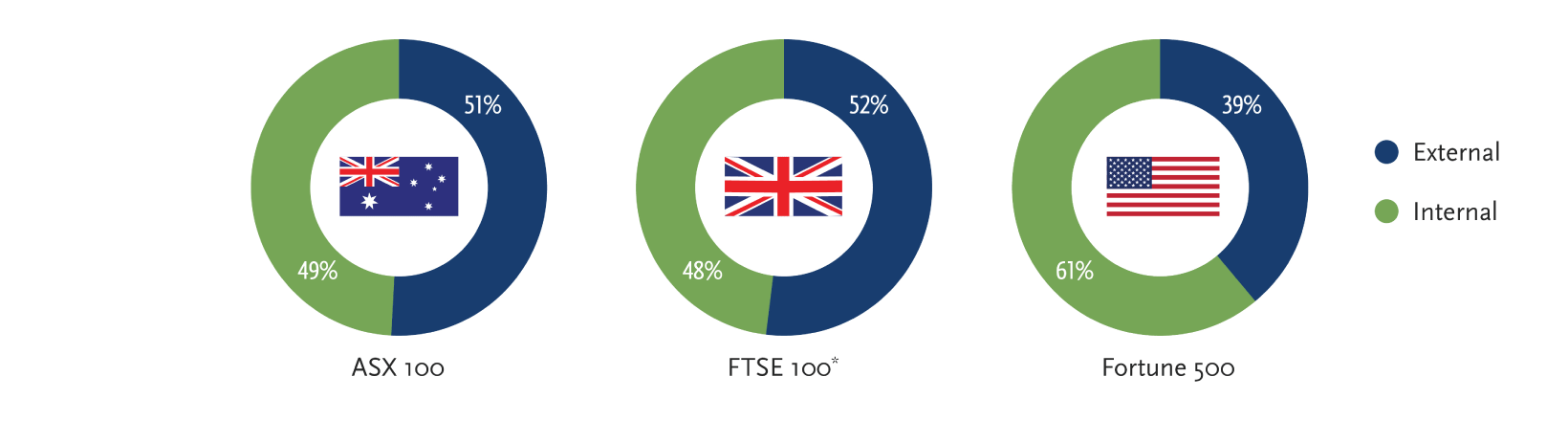

Internal vs. external appointments

The overall percentage of externally appointed CFOs and internally promoted CFOs is virtually identical: 51 percent are external, while 49 percent are internal. Those percentages mask notable differences by industry, however: 78 percent of CFOs in technology, media and telecommunications and 60 percent of industrial CFOs were brought in from outside the company, but only 39 percent of CFOs in the financial services sector and 31 percent in consumer goods were external appointments.

Among the 51 percent of externally appointed CFOs, the majority have been in the same industry throughout their careers — with one exception: only 25 percent have worked exclusively in consumer goods over their careers. On the other side of the spectrum, 100 percent of the externally appointed CFOs in financial services have spent their entire career in that industry.

By comparison...

The route to the top

Sixty-four percent of all ASX 100 CFOs have held the position of divisional or regional CFO prior to their current position, indicating that previous experience working directly with business leaders is highly valued. Other backgrounds for ASX 100 CFOs include:

-

59% have worked in professional services

-

38% have experience in group finance

-

36% have worked as group CFO

-

12% have treasury experience

-

8% have worked in investor relations

Forty-four percent of ASX 100 CFOs were group or divisional/regional CFO in their position that immediately preceded their appointment.

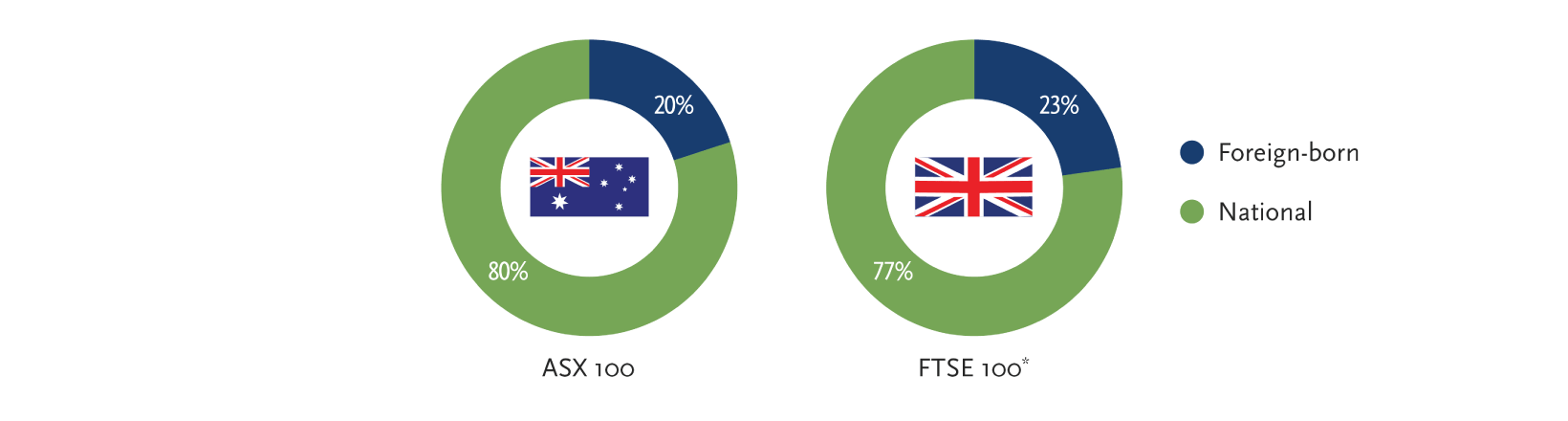

Majority of CFOs are Australian nationals

The great majority of Australia’s CFOs are homegrown: 80 percent of ASX 100 CFOs are Australia-born and educated. Of the 20 percent of executives who are foreign-born, the top three sources are the U.K., New Zealand and South Africa.

By comparison...

CFO tenure averages five years

The average tenure of ASX 100 CFOs is five years, and the majority (52%) have been in their position for less than five years. Roughly one-quarter (26%) have held the job for between five and 10 years.

Broken down by industry, CFOs in life sciences companies have the longest average tenure at 10.3 years, while CFOs in technology, media and telecommunications companies have an average tenure of 5.6 years.

By comparison...

Average tenure

Average age just over 50

Today, the average age of the ASX 100 CFO is 51 years old, which is in line with the averages seen in the U.K. and U.S. The majority of CFOs are between 46 and 50.

By comparison...

Average age

Most CFOs have international experience

Nearly two-thirds of ASX 100 CFOs (64%) have worked in countries other than Australia. We anticipate that this figure will climb as companies expand internationally, requiring CFOs with a more global mindset and incentivising finance leaders to take roles internationally. Analysed by sector, 28% of industrial CFOs have international experience, followed by financial services CFOs at 17%.

Few CFOs sit on boards

Ten percent of ASX 100 CFOs are members of their company boards. We anticipate that figure will steadily increase, particularly in heavily regulated industries. Within the 10 percent of CFOs who sit on their company’s board, 40 percent hold a second board seat in a listed company.

Route to CEO

The position of CFO represents a reasonable succession platform into the CEO role, based on our analysis. Twenty-five percent of ASX 100 CEOs have broader finance backgrounds, a notable percentage given the spread across industry sectors. Within this group, 13 executives were promoted having served as group CFO within the same company, one or two roles prior. The remaining 12 executives had finance experience earlier in their careers.

* These figures are taken from 2016 Spencer Stuart research. Fortune 500 nationality information is N/A.