7.1 The board agenda

A board meeting is clearly the chairman’s meeting, but the framing of the agenda is generally a joint effort between the chairman and the CEO. In this way, issues relating to both the company’s operation (internal) and its governance (external) get on to the agenda.

The chairman and the board should agree an annual programme of issues to be brought to the board. It is at this stage of framing the annual agenda that the contribution of the directors is most useful. Subject to that, any director should be free to ask for an item to be placed on the agenda at any time — this right is protected in most legal systems.

The benefit of an annual programme is that it ensures all relevant operational and strategy issues receive a regular hearing and, most importantly, that the specific responsibilities of the outside directors are identified, exercised, debated and recorded.

7.2 Strategy

In recent years, it has been a common complaint of board members that the preoccupation with governance has resulted in less and less time available for the discussion of strategy. Moreover, as we have observed, the lack of opportunity to make a meaningful contribution to the development of strategy has long been a frustration for outside directors, particularly in those countries where there is an expectation that the final strategy is the product of boardroom debate. Too often, strategy has been presented fully formed, with the contribution of outside directors limited to monitoring its proper implementation.

In a two-tier board system, the authorship of the strategy is clearly the responsibility of the executive. The role of the supervisory board is to provide constructive challenge and support and to monitor successful implementation of the strategy. Indeed, in Germany the supervisory board is expressly forbidden from involving itself in the creation of strategy. Elsewhere, directors increasingly see themselves in an active role, not just a supervisory one, and as a result expect to have greater involvement in framing strategy.

In the unitary board system, there is a clear expectation among non-executive directors that they will be closely engaged in the strategic-thinking process. This should include an understanding of the full context in which the strategic options were framed and reasons why some options were rejected.

Executives should be focused on the operation of the business, but the outside directors are required to have a 360-degree vision. Often it falls to outside directors to strike the balance between short-term performance and long-term strategic commitments, and to help articulate that balance to stakeholders.

As noted above, the first priority should be to establish where responsibility lies for strategy and what the respective roles of executives and outside directors are. For example, historically the role of the board has been to advise, approve or reject but not to design strategy. Today, the board must be more engaged in strategy development. A strategy committee is one such solution. Alternatively, strategy is increasingly an agenda item for full board discussion in the lead-up to the strategy meeting.

An annual strategy day is essential and is now best practice. This should be held outside the regular schedule of board meetings, but of itself this is not enough. Strategy, in its broadest sense, is no longer a matter for a one-day debate. The best boards seek mechanisms whereby outside directors can contribute their wider perspective to the framing of a company’s strategic direction and purpose.

Strategy is not created in a vacuum and is rarely static. Strategy must evolve through an iterative process at board level, taking account of changing circumstances, competitive disruption and fresh commercial challenges. Specific strategic initiatives such as an M&A transaction, a substantial investment or product launch, however, should always be subject to a rigorous post-mortem at the board.

7.3 Quality of debate

Good debate does not happen by accident. It requires active management by the chairman and mutual trust between directors who must feel that their contribution is neither taken personally nor disregarded. Equally, no one person should seek to, or be allowed to, dominate the debate. For real discussion to take place, all directors must be receptive to alternative points of view.

Sufficient time must be allocated to debate. Frequently, presentations by executives take too much time and repeat what is in board materials, with the result that discussion is not focused on the pressing issues. An executive summary or list of issues can help to focus the discussion. Presentations may be important for educating the board about complex business matters, but they should avoid repeating what is in the board papers.

Executives want to benefit from the mix of expertise around the boardroom; they want to be advised, not merely monitored. Non-executives want enough opportunity to share their insight and to discharge their responsibilities.

At the close of the debate, the chairman should ensure that all aspects of the issue have received attention and, once that is done, should summarise the principal points made and reflect the prevailing view. The responsibility of the board is collective; the quality of the debate and the way it is recorded are vital.

7.4 Meetings

Some boards have monthly meetings lasting three to four hours, while others choose to have longer meetings every two months.

Simple logistics may dictate that boards with an international membership are best served by fewer and longer board meetings.

Most companies now make full use of the freedom to conduct virtual meetings — assuming the company’s governance rules allow it.

Some may say that there is no real substitute for face-to-face engagement, but time and diary pressure means that attendance in person is not always possible. So some amount of “virtual” attendance is permissible, especially as attendance is now monitored and disclosed in many jurisdictions.

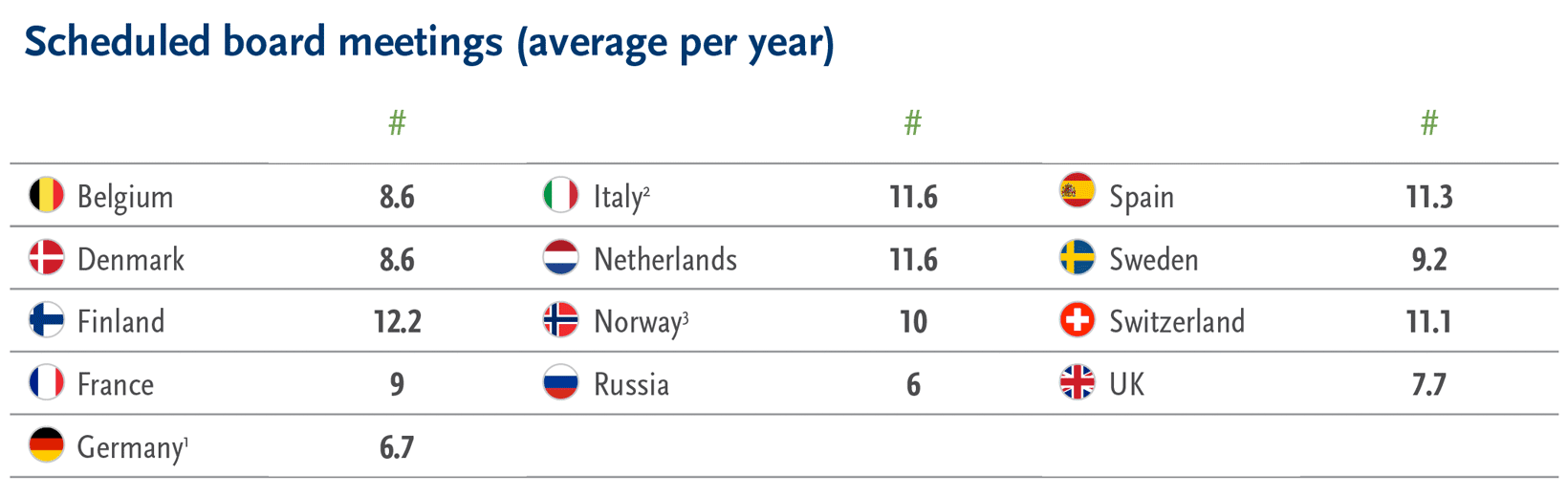

Businesses are complex mechanisms and the board’s responsibilities can only be properly discharged by frequent interaction with the company and its management. However, frequency is an elastic concept, stretching from two main board meetings each half year (the minimum mandated by German law) to one every month. The average number of scheduled board meetings for different countries can be found in the chart below.

Of course, events may dictate that meetings become more frequent at times of M&A, existential threat, etc. Weekly board meetings are not uncommon at such times, with more frequent meetings often being held by specifically constituted ad hoc committee.

7.5 Meeting materials

Above all, the policy for meetings should be that there are no surprises.

All board presentations should be circulated at least one full week before the meeting and only an executive summary presented during the meeting, in order to maximise discussion time. A balance should be struck between retrospection and looking forward; the rear-view mirror is important, but setting the direction of travel is more so.

Directors should be given easy and secure access to board papers via the internet and tablet devices and have the opportunity to store earlier papers. However, if individuals are more comfortable with traditional papers, then they too must be accommodated. Board administration is not designed for the convenience of the executive.

There is an increasing demand for more concise board papers, executive summaries and presentations. This way, questions are raised to stimulate the debate rather than offering lengthy descriptions. Too much detail in board papers can lead to a lower quality of debate, because directors end up spending too much time examining the detail and not enough considering the bigger picture. A clear understanding of the distinction between the detail provided as background and the issues to be debated during meetings is essential.

Standardisation of presentations can be helpful here. First, many agendas indicate the time available for each discussion. This requires some discretion and common sense from the chairman. Second, papers are often marked “for information”, “for discussion” or “for decision” or similar. This will also relate to how the agenda is framed, with less significant items coming at the end.

Each board should develop a common framework for board papers so the layout becomes familiar: for example, an executive summary, a substantive paper (which should be as short as possible) and background material relegated to appendices.

Even though the movement to electronic media does not appear to have reduced the volume of material for directors to read, there is growing pressure from many chairmen for board papers to be no more than a few pages long, with points for discussion and decision clearly highlighted.

That said, the information available to directors should not be limited to formal board meetings but should include a regular flow of material, including management accounts, analysts’ reports, presentations made on behalf of the company, media coverage and all significant announcements, both internal and external.

7.6 Meeting locations

Most boards benefit from seeing more aspects of a company’s operations than are encountered at head office. Many boards seek to meet from time to time outside the corporate headquarters and in an operational location, either domestic or overseas.

Indeed, the annual overseas visit has become a staple of many companies’ boardroom operations. Obviously, the ease and opportunity for such visits depend on the structure and international scale of the business, but the simple point is this: nothing makes a more positive contribution to corporate morale, or makes the board more visible and relevant, than its presence at the operational core of the businesses.

7.7 Social dynamics

Boards are social constructs and some element of social cohesion helps the debate.

A word of caution here. It is a legitimate ambition that fellow board members should view each other as valued colleagues; however this is different from viewing them as personal friends.

The best board relationships are characterised by collegial professionalism. Some chairmen believe that social events generate cohesion among board members and create the kind of atmosphere in which debate can thrive. So it is commonplace these days for board meetings to be preceded (or followed) by dinners. These settings provide an opportunity for less formal discussion and are often used to expose directors to members of the executive they might not otherwise encounter — all part of long-term succession planning.

A mingling of personal lives is less common, but in some countries chairmen think it helpful if there is at least one event a year when directors and their partners are together — this is a growing trend and part of humanising the board.

7.8 The non-executive directors’ meeting

The non-executive directors’ meeting — where the chairman sits with only the outside directors — is a growing feature of good governance. It provides an opportunity to raise issues of concern without the executive team present.

Meetings of the board without executives present

Belgium

At least once a year

Denmark

Not applicable — two-tier system

France

At least one per annum

Germany

Not applicable — two-tier system

Italy

At least one per annum of the independent directors

Netherlands

Recommended in the code but no prescribed number

Norway

Recommended and common practice to have a short meeting at the end of each board meeting

Spain

Not specified

Sweden

Not specified

Switzerland

No legal requirement; companies sometimes prescribe one to two per annum in their statutes

UK

Code recommends that chairman meet with independent non-executive directors and also that the non-executive directors meet without the chairman at least annually, a meeting usually chaired by the senior independent director

Sometimes such sessions precede the board meeting. More often they follow it, which is more logical because the agenda often will be driven by issues arising at the meeting. Some companies favour less frequent meetings, often in a more relaxed setting.

While this is easy to accommodate in the two-tier structure, unitary boards must be careful to avoid a “them and us” division between outside directors and executives.

In our view, the opportunity for directors to have a conversation involving exclusively the “outside” perspective is of great value.

7.9 Keep it in the boardroom

Confidentiality is vital to boardroom discussions. All directors must feel free to speak without risk of their views or the board discussion being reported other than through the medium of the formal minutes or some other authorised communication.

It is often said that some of the most effective problem-solving on a board is done outside the boardroom, in the corridors or informally elsewhere. This ebb and flow of discussion is helpful, but it is far more important that the formal record of the board’s deliberations — the audit trail — is visible and secure. This is only possible if all material interactions take place in the boardroom. All directors should be alert to this requirement. Transparency dictates that the major discussions and decisions are subject to proper record and minute-taking.

7.10 Resolving conflict

Conflicts must be resolved before consensus can be achieved.

It is the chairman’s job to manage conflict on the board. It is our experience that a dysfunctional board is generally a sign of a weak chairman.

A strong and effective chairman will encourage an open and honest discussion, will tolerate disagreement but will understand that the discussion must end in consensus.

It is interesting to note that voting on the board rarely happens in practice.

The risk all boards face is that consensus can mean taking the path of least resistance. Perhaps the hardest challenge for the successful chairman of any meeting is to bring issues to the surface, permit disagreement, confront the arguments and yet achieve consensus without sacrificing principle.

The ultimate protest for the director who cannot support the decision is resignation. It is surprising how little this sanction is used (although it is possibly more frequently threatened). In some cases, this may be because boards prefer consensus to confrontation — even when they believe executives could be wrong.

Some outside directors are reluctant to surrender their position on the board, even on a matter of principle. This is the wrong attitude. An outside director should not assume a long, untroubled life. The freedom to walk away is essential; there is no shame in a clear disagreement openly recognised.

It is telling that few of the corporate catastrophes of recent years have been preceded by visible board turmoil. Were the boards complacent or ill-informed about the gathering storm?

7.11 The knowledge gap

Outside directors might spend a maximum of 30 days on the business, while executive directors are on the case 24/7 — but both sets of directors are accountable 365 days of the year. By definition, the executives have knowledge of, and access to, information concerning the company which the outside directors can never match.

This asymmetry of information is most keenly felt on unitary boards, where outside directors and executives take equal responsibility for decisions based on different levels of information and understanding. However, it is also relevant in two-tier boards when the job of supervision will depend crucially on the quality of information made available to the supervisory board.

To use an analogy from a court of law, the board papers are the evidence and the meetings are the opportunity for a cross-examination of the principal witnesses.

The essential point is that the flow of paperwork to the board, and the chance to interrogate and question in a constructive manner, is the opportunity for the outside director to rebalance the information deficit.

This underlines the importance of a commitment on the part of the outside director to understanding the company and how it works — not just in and around the board meetings, but constantly.

7.12 The company secretary’s contribution

The most successful boards are those that are administered well. Responsibility for this often falls to the company secretary, general counsel or head of secretariat — the title varies but the responsibilities do not.

The role of company secretary (or similar) has grown in recent years, as has the reputation of the function. In some jurisdictions, their authority and position is protected by law.

The board will require advice both on the legal implications of its operations and on issues of corporate law, practice and governance.

In larger organisations these separate strands of advice are given by different individuals. The general counsel or chief legal officer is responsible for operational legal advice, often reporting directly to the chief executive; the company secretary is responsible for governance and compliance and often reports directly to the chairman.

The current trend is towards this separation of roles, given that the scale and complexity of regulatory compliance has increased so much in recent years. But this is not an inevitable result. Single point responsibility for all legal matters is, in our view, the better way. Company secretary expertise can be located in individual members of a legal team, with one person responsible overall.

It is best practice for companies to support directors in taking independent advice, at the company’s expense, whenever they feel it appropriate to do so. In some jurisdictions this right is enshrined by statute. This is a recognition that, on occasion, the interests of individual directors and those of the company itself might diverge.