9.1 Measuring board effectiveness

Public expectation of board performance is increasing and boards must be ready to demonstrate that they are both fit for purpose and self-aware.

Just as directors are required to be more professional in the performance of their duties, so the monitoring and evaluation of that performance sets a good example to the organisation as a whole. It reinforces a culture of self-reflection and openness to constructive criticism.

How effectively the board carries out its duties should therefore concern every board member, not just the chairman.

An annual board assessment plays a critical role in ensuring that any problems in how the board functions are brought to light and addressed in a discreet and timely manner. Board assessments frequently result in improved processes, more accountability and transparent communication, enhanced trust and better decision-making.

Clearly, multiple factors contribute to board effectiveness, from the chairman’s leadership and board composition to the quality of the information provided to directors and the nature of debate. The CEO’s attitude and receptiveness is also relevant.

These annual evaluations are frequently self-assessments, often conducted by questionnaire under the direction of the deputy chairman, senior independent director, or often the company secretary. Frequently, the results are referred to as part of the governance report published by the company.

A board should discuss how it will measure its own effectiveness and what it needs to address, for example:

- What are the key issues for the company? Does the board address the needs of the business, rather than simply governance or regulatory matters?

- Is the board ensuring that sustainable value is created and competitiveness assured?

- To what extent does the board adhere to or surpass local governance recommendations?

- Is the board working well as a group? Is each individual board member fully effective?

- Is there trust and collegiality among directors and between the board and the management team?

- Are the board committees effective and do they keep the full board properly informed about their work?

Boards should not expect too much of an internally managed board assessment exercise. Self-criticism is likely to be muted and any changes recommended will be modest — a weakness of self-regulation. Those who mark their own homework are likely to award high grades.

The ingredients of a successful board assessment

In our experience, clients derive the highest value from an external board assessment when the approach pursues the following key principles:

- The assessment is specifically tailored to the client’s current business context

- The scope is determined on the basis of a comprehensive briefing by the chairman and agreed stakeholders

- Board members are interviewed individually on a confidential basis and asked both for their qualitative and quantitative assessment of the areas that determine board effectiveness

- The board’s performance is benchmarked against equivalent companies

- The assessments are conducted by consultants of seniority and experience.

9.2 External facilitation

To provide greater rigour in the area of board assessment, we recommend an externally facilitated exercise — at least once every three years. This appears as a governance code recommendation in some jurisdictions. In some markets externally facilitated evaluation happens annually.

An external assessment conducted by an experienced and neutral facilitator provides a far richer and more nuanced picture of the board’s functioning and effectiveness. Most importantly, it is more likely to provide a true and honest one.

The identification of substantive issues and the ability to benchmark the board against best practices elsewhere are the two principal reasons why an external evaluation can provide the information that shareholders and other stakeholders seek.

A well-conducted external assessment of the board will have a number of objectives going far beyond simply reporting on how things are.

A key ambition will be to enhance the board’s relationship with management and to ensure that communication among directors and with the executive is more transparent. An ambition will be to improve the board’s processes of working together with an aim of building trust among directors, thus allowing for better decision-making, particularly during periods of crisis and transition.

There is real benefit in board assessments being done on a consistent and regular basis. It helps set the right tone at the top and many high-performing boards consider an externally facilitated annual board assessment to be best practice, not least because it enhances the recruitment process.

An effective performance evaluation requires expertise and professionalism on the part of the evaluator. Given the growing legislative requirements for external evaluation, an increasing number of individuals and organisations are offering their services. However, for the best results boards should choose as an external facilitator a firm that has the resources and experience to do the job properly. Each evaluation should be conducted by a specialist in the field of board and corporate behaviour that offers these services across many jurisdictions, bringing experience and best practice from other relevant markets.

The case for the leadership consultancy as board assessment provider

There are at least three reasons why such a high-quality consultancy should be appointed:

- It will have a unique perspective on boardroom composition and has the data to provide meaningful benchmarks

- Boards are open increasingly to learning from governance practices in other jurisdictions, and a global consultancy can provide recommendations based on international best practice

- It has access to behavioural expertise and professional analysis of what works well and makes an effective board.

The experience and depth of boardroom expertise available from a leadership consulting firm is precisely the skill set required to perform a proper board evaluation.

Could such firms be conflicted when seeking to provide a board evaluation service, at least to their existing clients?

The answer is emphatically not. Such potential conflicts are commonplace in professional services and successfully dealt with by erecting clearly understood information barriers. Organisational separation ensures an absence of conflict.

9.3 Individual evaluation

Just as executives are subject to annual performance reviews, so the individual performance of outside directors has become the subject of regular evaluation in some countries.

These often take the form of peer reviews. As part of the annual board assessment, opportunity is given to directors to comment, indirectly, on the contribution of their colleagues.

This is an emerging practice, but as the role of the outside director comes to be seen as a distinct function (and sometimes a career choice) so their performance and contribution will be judged on an annual basis, just like that of any other professional or executive within the organisation.

However, the annual review should be regarded only as a summary of what is in fact a constant evaluation of the board’s performance. A good chairman will be alert to how the board and individual directors are performing and should be quick to intervene when needed.

In this respect, we urge all boards to be self-aware all of the time — rather than only turning to this issue once a year.

If an individual is failing to contribute in the way that is expected of an independent director, it is the chairman’s responsibility to advise on how the individual’s behaviour and contribution can be changed, just as any other executive would be managed. Persistent under-performance will inevitably lead to departure.

The chairman’s own performance should not be overlooked. It is best included as part of the annual review and is normally led by the senior independent director or deputy chairman.

9.4 Reporting to shareholders

The performance of the whole board should be the subject of a report to shareholders, as a matter of principle. The report should detail what evaluation has been made and, where required, what remedial and/or developmental steps the board will be taking.

This obligation is best met by the nomination committee, and the resulting analysis will either be included in the nomination committee’s report to shareholders or in a more general section on corporate governance — both of which appear in the annual report.

9.5 Non-executive remuneration

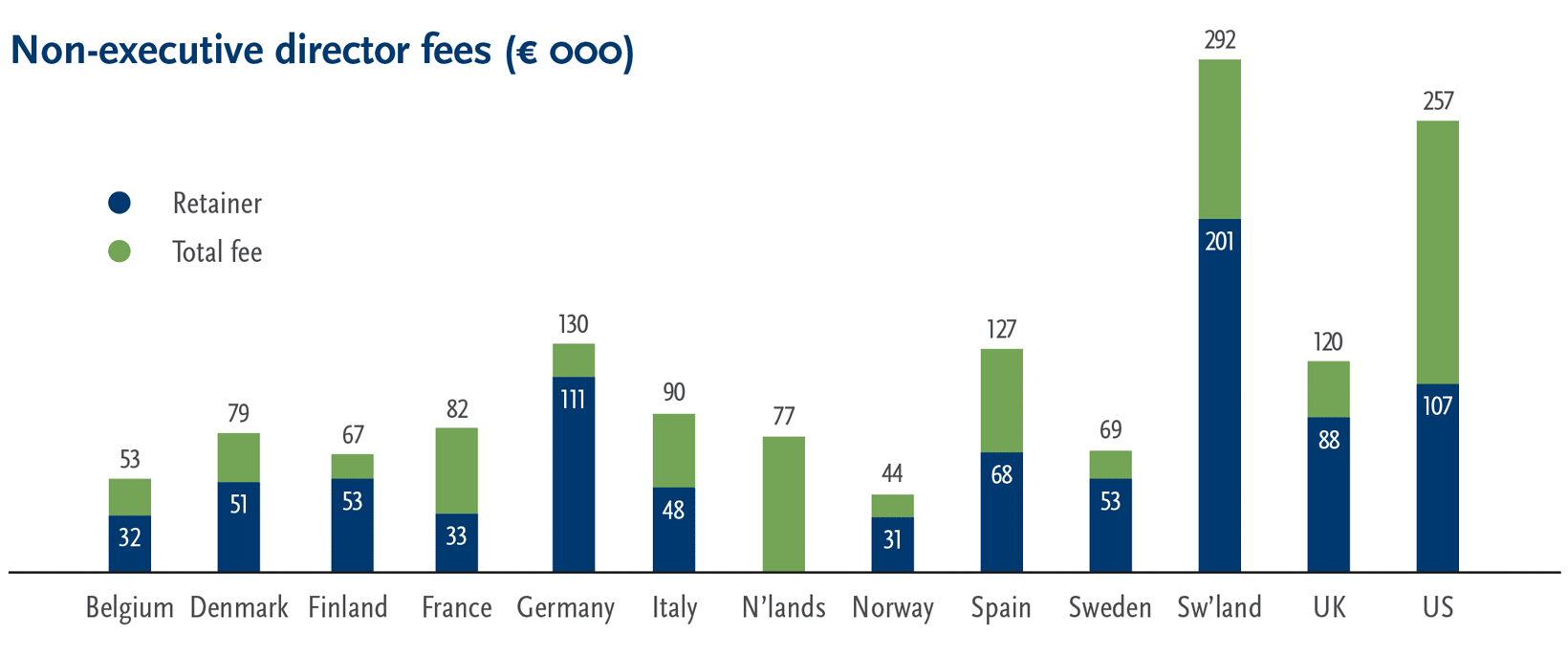

The increasing demands on directors in terms of time commitment and responsibility has led to a gradual, though small, increase in the level of fees paid to outside directors. By contrast, there has been a marked increase in the remuneration of executive directors.

The growing scrutiny and scepticism surrounding levels of executive reward has already spilt over to board remuneration more broadly.

It is important that levels of reward for outside directors should be reasonable and defensible. Fees should be commensurate with the time directors are required to devote and the scale and impact of the business. However, the overriding requirement is that outside directors should remain independent of the organisation on whose board they serve.

A few philosophical questions arise when thinking about non-executive director remuneration, for example:

- Can an outside director who relies exclusively upon director’s fees from a single organisation ever be construed as totally independent?

- If an outside director is rewarded on a similar basis and on the same metrics as the executive, how can their judgement ever be objective?

Board director remuneration is a matter for each company to decide. It should be a matter of common sense to determine when remuneration levels are too high relative to the salaries within the organisation and to remuneration in society at large.

Indeed, any organisation with an opaque governance structure but with high rewards on offer should be avoided by the responsible outside director.

The issue of rewarding non-executive directors with shares provokes strong opinion. Some investment institutions oppose this practice on the grounds that it may lead to the directors adopting short-term views. Others object on the grounds that share price performance may not be linked to corporate performance. On the other hand, proponents claim they are only aligning their own rewards with those of the shareholders themselves.

The principal risk we identify is that this very alignment contains the seeds of its own destruction. If the aim of the board is to promote the long-term success of the company, part of the role of the outside director is to ensure that the executives do not take short-term measures to inflate the share price and their own rewards.

If the directors share in those rewards, they are compromised in performing one of their central duties. For this reason we would recommend that boards should consider carefully whether it is appropriate for outside directors to be rewarded in shares.

An acceptable measure of alignment is best achieved by requiring each director to purchase shares to a value of at least their annual fee. Some companies choose to disclose the shareholdings of all directors, executive and non-executive, including the growth in value of those shares since purchase.